On Wednesday, President Biden announced an agreement to provide Intel with $8.5 billion in direct funding and $11 billion in loans under the CHIPS and Science Act. Intel will use this funding for its wafer fabs in Arizona, Ohio, New Mexico, and Oregon. As reported in our December 2023 newsletter, the CHIPS Act provides a total of $52.7 billion in funding for the U.S. semiconductor industry, including $39 billion in manufacturing incentives. Before Intel's allocation, the CHIPS Act had already allocated a total of $1.7 billion to GlobalFoundries, Microchip Technology, and BAE Systems, according to the Semiconductor Industry Association (SIA).

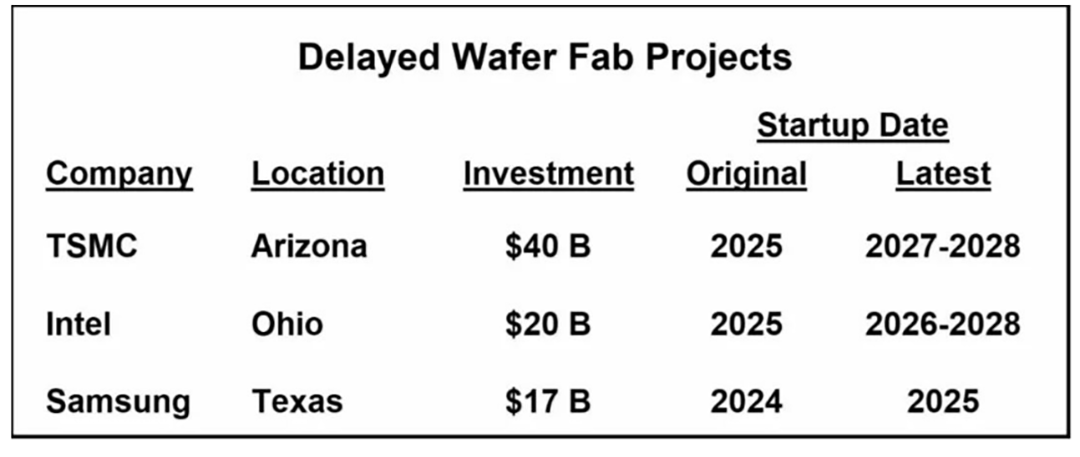

Progress on funding under the CHIPS Act has been slow, with the first allocation announced over a year after its passage. Due to the slow disbursement, some large semiconductor fab projects in the United States have been delayed. TSMC also noted difficulties in finding qualified construction workers. Intel attributed the delays partly to slowing sales.

Other countries have also allocated funds to promote semiconductor production. In September 2023, the European Union passed the European Chips Act, which stipulates €430 billion (approximately $470 billion) in public and private investments for the semiconductor industry. In November 2023, Japan allocated ¥2 trillion (approximately $13 billion) for semiconductor manufacturing. Taiwan enacted legislation in January 2024 to provide tax incentives for semiconductor companies. In March 2023, South Korea passed a bill to provide tax incentives for strategic technologies, including semiconductors. China is expected to establish a government-supported $40 billion fund to subsidize its semiconductor industry.

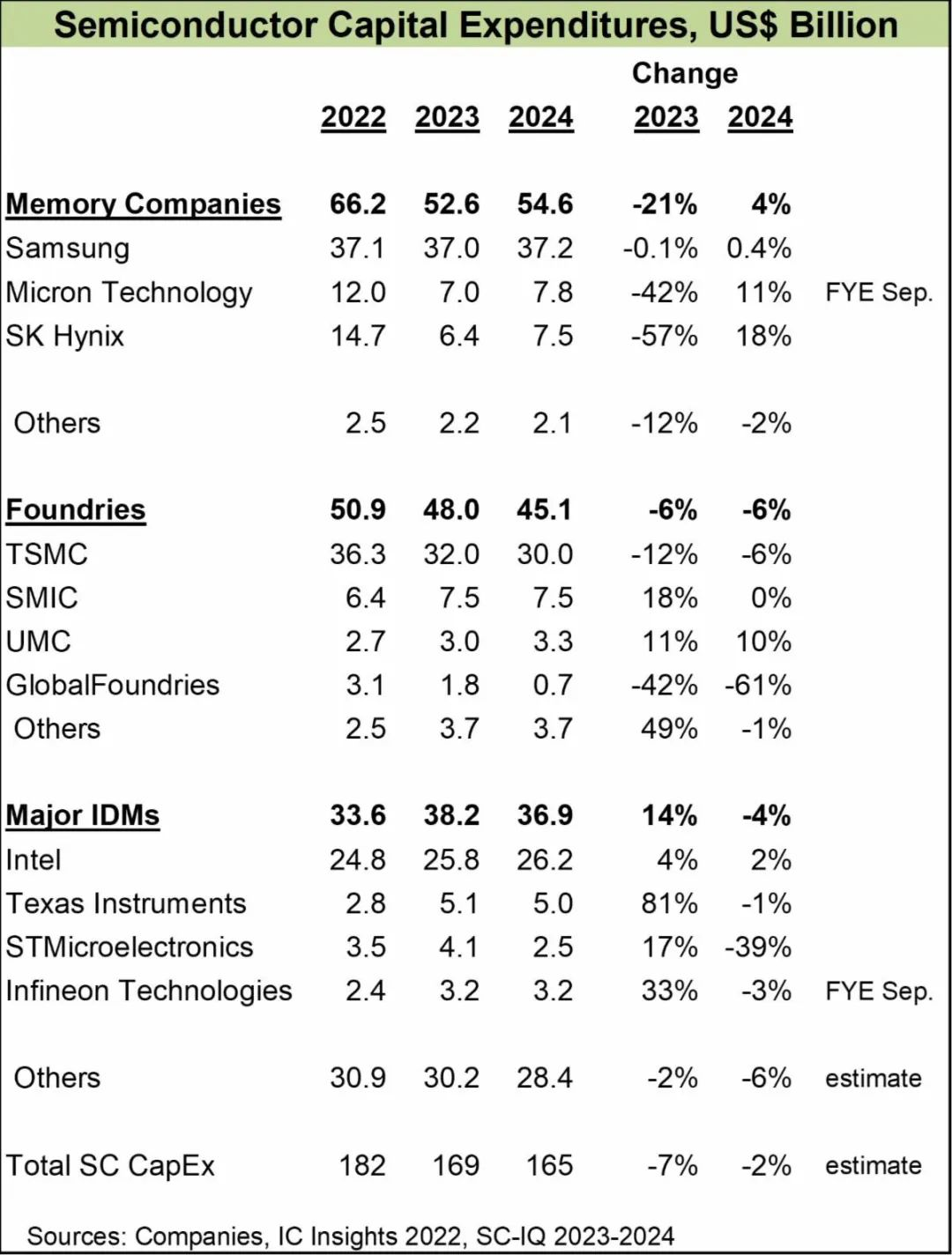

What are the prospects for semiconductor industry capital expenditure (CapEx) this year? The CHIPS Act aims to stimulate capital expenditure, but most of the impact will not be evident until after 2024. Last year, the semiconductor market disappointingly declined by 8.2%, leading many companies to adopt a cautious approach to capital expenditure in 2024. We estimate that total semiconductor CapEx in 2023 was $169 billion, a 7% decrease from 2022. We predict a 2% decrease in CapEx for 2024.

With the recovery of the memory market and the expected increase in demand from new applications such as artificial intelligence, major memory companies are expected to increase capital expenditure in 2024. Samsung plans to maintain relatively flat spending in 2024 at $37 billion but did not cut capital expenditure in 2023. Micron Technology and SK Hynix significantly reduced capital expenditure in 2023 and plan for double-digit growth in 2024.

The largest foundry, TSMC, plans to spend approximately $28 billion to $32 billion in 2024, with a median of $30 billion, a 6% decrease from 2023. SMIC plans to maintain capital expenditure flat, while UMC plans to increase by 10%. GlobalFoundries expects a 61% reduction in capital expenditure in 2024 but will increase spending over the next few years with the construction of a new fab in Malta, New York.

Among Integrated Device Manufacturers (IDMs), Intel plans to increase capital expenditure by 2% in 2024 to $26.2 billion. Intel will increase capacity for both foundry customers and internal products. Texas Instruments' capital expenditure remains roughly flat. TI plans to spend approximately $5 billion per year until 2026, primarily for its new fab in Sherman, Texas. STMicroelectronics will reduce capital expenditure by 39%, while Infineon Technologies will reduce by 3%.

Samsung, TSMC, and Intel, the three largest spenders, are expected to account for 57% of semiconductor industry capital expenditure by 2024.

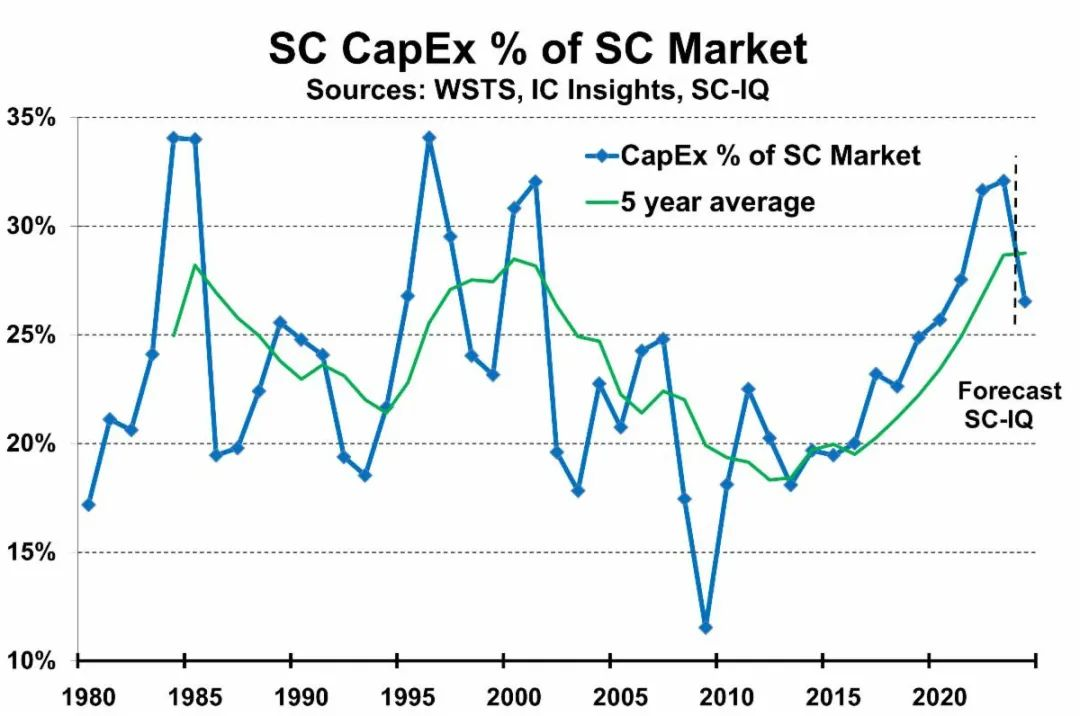

What is the appropriate level of capital expenditure relative to the semiconductor market? The volatility of the semiconductor market is well-known. Over the past 40 years, the annual growth rate has declined from 46% in 1984 to 32% in 2001. While the industry's volatility has diminished with maturity, its growth rate reached 26% over the past five years. It declined by 12% in 2021 and 12% in 2019. Semiconductor companies need to plan their capacity for the coming years. Building a new fab typically takes about two years, with additional time needed for planning and financing. As a result, the proportion of semiconductor capital expenditure to the semiconductor market varies significantly, as shown below.

2---Silicon Carbide: Towards a new era of wafers

The ratio of semiconductor capital expenditure to market size has ranged from a high of 34% to a low of 12%. The five-year average ratio falls between 28% and 18%. Over the entire period from 1980 to 2023, capital expenditure has accounted for 23% of the semiconductor market. Despite fluctuations, the long-term trend of this ratio remains fairly consistent. Based on expected strong market growth and a decline in capital expenditure, we anticipate this ratio to decrease from 32% in 2023 to 27% in 2024.

Most forecasts predict semiconductor market growth in the range of 13% to 20% for 2024. Our semiconductor intelligence forecasts a growth of 18%. If 2024 performs as strongly as expected, companies may increase their capital expenditure plans over time. We can expect to see positive changes in semiconductor capital expenditure in 2024.

Post time: Apr-08-2024