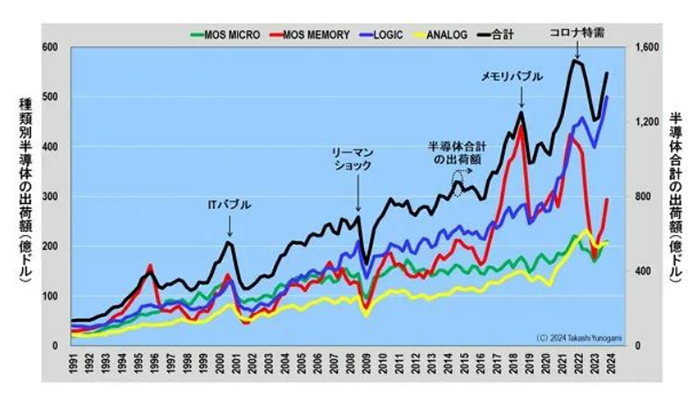

From 2021 to 2022, there was a rapid growth in the global semiconductor market due to the emergence of special demands resulting from the COVID-19 outbreak. However, as the special demands caused by the COVID-19 pandemic ended in the latter half of 2022 and plunged into one of the most severe recessions in history in 2023.

However, the Great Recession is expected to bottom out in 2023, with a comprehensive recovery expected this year (2024).

In fact, looking at the quarterly semiconductor shipments across various types, Logic has already surpassed the peak caused by the special demands of COVID-19 and set a new historical high. Additionally, Mos Micro and Analog are likely to reach historical highs in 2024, as the decline caused by the end of COVID-19 special demands is not significant (Figure 1).

Among them, Mos Memory experienced a significant decline, then bottomed out in the first quarter (Q1) of 2023 and began its journey towards recovery. However, it seems to still require a considerable amount of time to reach the peak of COVID-19 special demands. However, if Mos Memory surpasses its peak, semiconductor total shipments will undoubtedly hit a new historical high. In my opinion, if this happens, it can be said that the semiconductor market has fully recovered.

However, looking at the changes in semiconductor shipments, it is evident that this view is mistaken. This is because, while shipments of Mos Memory, which is in recovery, have largely recovered, shipments of Logic, which reached historical highs, are still at extremely low levels. In other words, to truly revive the global semiconductor market, shipments of logic units must increase significantly.

Therefore, in this article, we will analyze semiconductor shipments and quantities for various types of semiconductors and total semiconductors. Next, we will use the difference between Logic shipments and shipments as an example to show how TSMC's shipments of wafers are lagging behind despite rapid recovery. Additionally, we will speculate on why this difference exists and suggest that the full recovery of the global semiconductor market may be delayed until 2025.

In conclusion, the current appearance of semiconductor market recovery is a "illusion" caused by NVIDIA's GPUs, which have extremely high prices. Therefore, it seems that the semiconductor market will not fully recover until foundries such as TSMC reach full capacity and Logic shipments reach new historical highs.

Semiconductor Shipment Value and Quantity Analysis

Figure 2 depicts the trends in shipment value and quantity for various types of semiconductors as well as the entire semiconductor market.

The shipment volume of Mos Micro peaked in the fourth quarter of 2021, bottomed out in the first quarter of 2023, and began to recover. On the other hand, the shipment quantity showed no significant change, remaining almost flat from the third to the fourth quarter of 2023, with a slight decline.

Mos Memory's shipment value began to decline significantly from the second quarter of 2022, bottomed out in the first quarter of 2023, and started to rise, but only recovered to around 40% of the peak value in the fourth quarter of the same year. Meanwhile, the shipment quantity has recovered to around 94% of the peak level. In other words, the factory utilization rate of memory manufacturers is considered to be approaching full capacity. The question is how much DRAM and NAND flash prices will increase.

Logic's shipment quantity peaked in the second quarter of 2022, bottomed out in the first quarter of 2023, then rebounded, reaching a new historical high in the fourth quarter of the same year. On the other hand, the shipment value peaked in the second quarter of 2022, then declined to around 65% of the peak value in the third quarter of 2023 and remained flat in the fourth quarter of the same year. In other words, there is a significant discrepancy between the behavior of shipment value and shipment quantity in Logic.

Analog shipment quantity peaked in the third quarter of 2022, bottomed out in the second quarter of 2023, and has since remained stable. On the other hand, after peaking in the third quarter of 2022, the shipment value continued to decline until the fourth quarter of 2023.

Finally, overall semiconductor shipment value decreased significantly from the second quarter of 2022, bottomed out in the first quarter of 2023, and started to rise, recovering to around 96% of the peak value in the fourth quarter of the same year. On the other hand, the shipment quantity also decreased significantly from the second quarter of 2022, bottomed out in the first quarter of 2023, but has since remained flat, at around 75% of the peak value.

From the above, it appears that Mos Memory is the problem area if only shipment quantity is considered, as it has only recovered to around 40% of the peak value. However, taking a broader perspective, we can see that Logic is a major concern, as despite reaching historical highs in shipment quantity, shipment value has stagnated at around 65% of the peak value. The impact of this difference between Logic's shipment quantity and value seems to extend to the entire semiconductor field.

In summary, the recovery of the global semiconductor market depends on whether the prices of Mos Memory increase and whether the shipment quantity of Logic units significantly increases. With DRAM and NAND prices continuously rising, the biggest issue will be increasing the shipment quantity of Logic units.

Next, we will explain the behavior of TSMC's shipment quantity and wafer shipments to specifically illustrate the difference between Logic's shipment quantity and wafer shipments.

TSMC Quarterly Shipment Value and Wafer Shipments

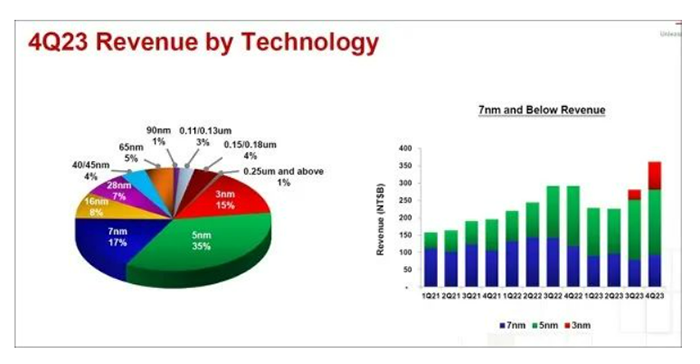

Figure 3 illustrates TSMC's sales breakdown by node and the sales trend of 7nm and above processes in the fourth quarter of 2023.

TSMC positions 7nm and beyond as advanced nodes. In the fourth quarter of 2023, 7nm accounted for 17%, 5nm for 35%, and 3nm for 15%, totaling 67% of advanced nodes. Additionally, the quarterly sales of advanced nodes have been increasing since the first quarter of 2021, experienced a decline once in the fourth quarter of 2022, but bottomed out and began to rise again in the second quarter of 2023, reaching a new historical high in the fourth quarter of the same year.

In other words, if you look at the sales performance of advanced nodes, TSMC performs well. So, how about TSMC's overall quarterly sales revenue and wafer shipments (Figure 4)?

The chart of TSMC's quarterly shipment value and wafer shipments roughly aligns. It peaked during the 2000 IT bubble, declined after the 2008 Lehman shock, and continued to decline after the bursting of the 2018 memory bubble.

However, the behavior after the peak of the special demand in the third quarter of 2022 differs. The shipment value peaked at $20.2 billion, then sharply declined but began to rebound after bottoming out at $15.7 billion in the second quarter of 2023, reaching $19.7 billion in the fourth quarter of the same year, which is 97% of the peak value.

On the other hand, quarterly wafer shipments peaked at 3.97 million wafers in the third quarter of 2022, then plummeted, bottoming out at 2.92 million wafers in the second quarter of 2023, but remained flat thereafter. Even in the fourth quarter of the same year, although the number of wafers shipped significantly decreased from the peak, it still remained at 2.96 million wafers, a reduction of over 1 million wafers from the peak.

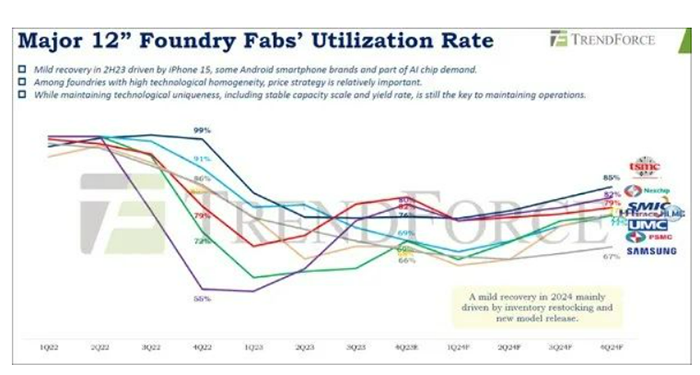

The most common semiconductor produced by TSMC is Logic. TSMC's fourth-quarter 2023 sales of advanced nodes reached a new historical high, with overall sales recovering to 97% of the historical peak. However, quarterly wafer shipments were still over 1 million wafers less than during the peak period. In other words, TSMC's overall factory utilization rate is only about 75%.

Regarding the global semiconductor market as a whole, Logic shipments have declined to around 65% of the peak during the COVID-19 special demand period. Consistently, TSMC's quarterly wafer shipments have decreased by over 1 million wafers from the peak, with the factory utilization rate estimated to be around 75%.

Looking ahead, for the global semiconductor market to truly recover, Logic shipments need to increase significantly, and to achieve this, the utilization rate of foundries led by TSMC must approach full capacity.

So, when exactly will this happen?

Predicting Utilization Rates of Major Foundries

On December 14, 2023, the Taiwan research company TrendForce held the "Industry Focus Information" seminar at the Grand Nikko Tokyo Bay Maihama Washington Hotel. At the seminar, TrendForce analyst Joanna Chiao discussed "TSMC's Global Strategy and the Semiconductor Foundry Market Outlook for 2024." Among other topics, Joanna Chiao talked about predicting foundry utilization rates (Figure

When will Logic shipments increase?

Is this 8% significant or insignificant? Although this is a subtle question, even by 2026, the remaining 92% of wafers will still be consumed by non-AI semiconductor chips. The majority of these will be Logic chips. Therefore, for Logic shipments to increase and for major foundries led by TSMC to reach full capacity, demand for electronic devices such as smartphones, PCs, and servers must increase.

In summary, based on the current situation, I don't believe that AI semiconductors like NVIDIA's GPUs will be our savior. Therefore, it is believed that the global semiconductor market will not fully recover until 2024, or even be delayed until 2025.

However, there is another (optimistic) possibility that could overturn this prediction.

So far, all the AI semiconductors explained have been referring to semiconductors installed in servers. However, there is now a trend of performing AI processing on terminals (edges) such as personal computers, smartphones, and tablets.

Examples include Intel's proposed AI PC and Samsung's attempts to create AI smartphones. If these become popular (in other words, if innovation occurs), the AI semiconductor market will rapidly expand. In fact, the US research firm Gartner predicts that by the end of 2024, shipments of AI smartphones will reach 240 million units, and shipments of AI PCs will reach 54.5 million units (for reference only). If this prediction comes true, demand for cutting-edge Logic will increase (in terms of shipment value and quantity), and the utilization rates of foundries such as TSMC will rise. Additionally, demand for MPUs and memory will also surely grow rapidly.

In other words, when such a world arrives, AI semiconductors should be the real savior. Therefore, from now on, I would like to focus on the trends of edge AI semiconductors.

Post time: Apr-08-2024