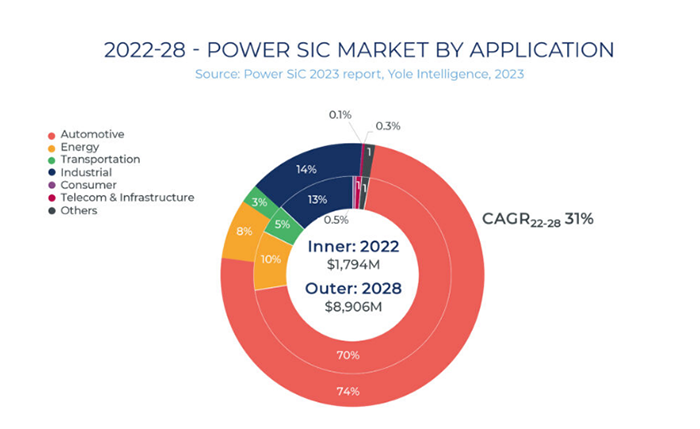

In recent years, with the continuous penetration of downstream applications such as new energy vehicles, photovoltaic power generation, and energy storage, SiC, as a new semiconductor material, plays an important role in these fields. According to Yole Intelligence's Power SiC Market Report released in 2023, it is predicted that by 2028, the global market size of power SiC devices will reach nearly $9 billion, representing a growth of approximately 31% compared to 2022. The overall market size of SiC semiconductors is showing a steady expansion trend.

Among numerous market applications, new energy vehicles dominate with a 70% market share. Currently, China has become the world's largest producer, consumer, and exporter of new energy vehicles. According to the "Nikkei Asian Review," in 2023, driven by new energy vehicles, China's automobile exports surpassed Japan for the first time, making China the world's largest automobile exporter.

Faced with the booming market demand, China's SiC industry is ushering in a critical development opportunity.

Since the release of the "Thirteenth Five-Year Plan" for National Science and Technology Innovation by the State Council in July 2016, the development of third-generation semiconductor chips has received high attention from the government and has received positive responses and extensive support in various regions. By August 2021, the Ministry of Industry and Information Technology (MIIT) further included third-generation semiconductors in the "Fourteenth Five-Year Plan" for industrial science and technology innovation development, injecting further momentum into the growth of the domestic SiC market.

Driven by both market demand and policies, domestic SiC industry projects are emerging rapidly like mushrooms after rain, presenting a situation of widespread development. According to our incomplete statistics, as of now, SiC-related construction projects have been deployed in at least 17 cities. Among them, Jiangsu, Shanghai, Shandong, Zhejiang, Guangdong, Hunan, Fujian, and other regions have become important hubs for the development of the SiC industry. In particular, with the new project of ReTopTech put into production, it will further strengthen the entire domestic third-generation semiconductor industry chain, especially in Guangdong.

The next layout for ReTopTech is the 8-inch SiC substrate. Although 6-inch SiC substrates currently dominate the market, the industry's development trend is gradually shifting towards 8-inch substrates due to cost reduction considerations. According to GTAT's predictions, the cost of 8-inch substrates is expected to be reduced by 20% to 35% compared to 6-inch substrates. Currently, well-known SiC manufacturers such as Wolfspeed, ST, Coherent, Soitec, Sanan, Taike Tianrun, and Xilinx Integration, both domestic and international, have begun to gradually transition to 8-inch substrates.

In this context, ReTopTech plans to establish a Large-Size Crystal Growth and Epitaxy Technology Research and Development Center in the future. The company will collaborate with local key laboratories to engage in cooperation in instrument and equipment sharing and material research. Additionally, ReTopTech plans to strengthen innovation cooperation in crystal processing technology with major equipment manufacturers and engage in joint innovation with leading downstream enterprises in the research and development of automotive devices and modules. These measures aim to enhance China's research and development and industrialization manufacturing technology level in the field of 8-inch substrate platforms.

The third-generation semiconductor, with SiC as its primary representative, is universally recognized as one of the most promising subfields within the entire semiconductor industry. China possesses a complete industrial chain advantage in third-generation semiconductors, covering equipment, materials, manufacturing, and applications, with the potential to establish global competitiveness.

Post time: Apr-08-2024